The T-Shaped CFO: Understanding breadth of knowledge vs deep expertise | Zanda Blog

10 Nov, 20259

For many founders, hiring their first CFO can feel like stepping into the unknown. What does a CFO actually do in a startup? How do you know whether your company really needs one? And once you bring them on board, how should you measure their impact?

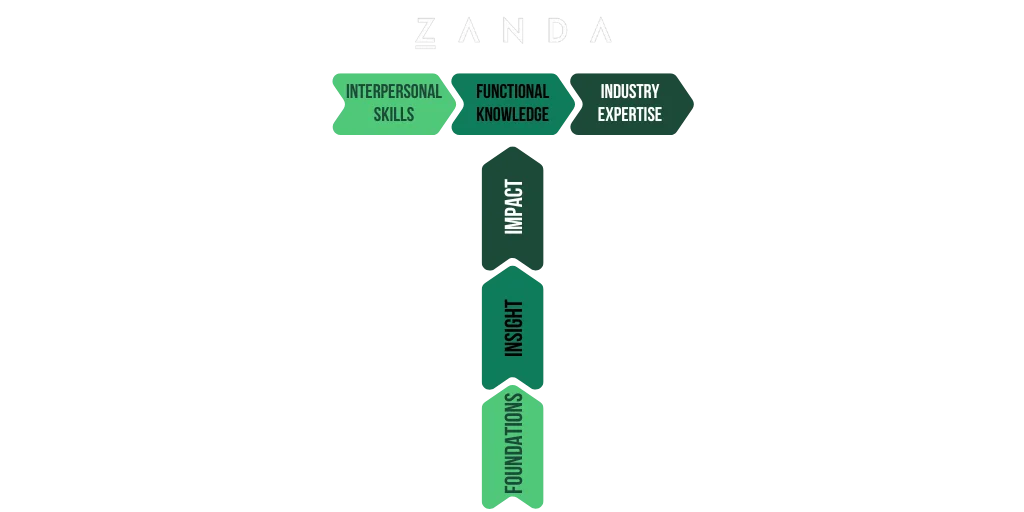

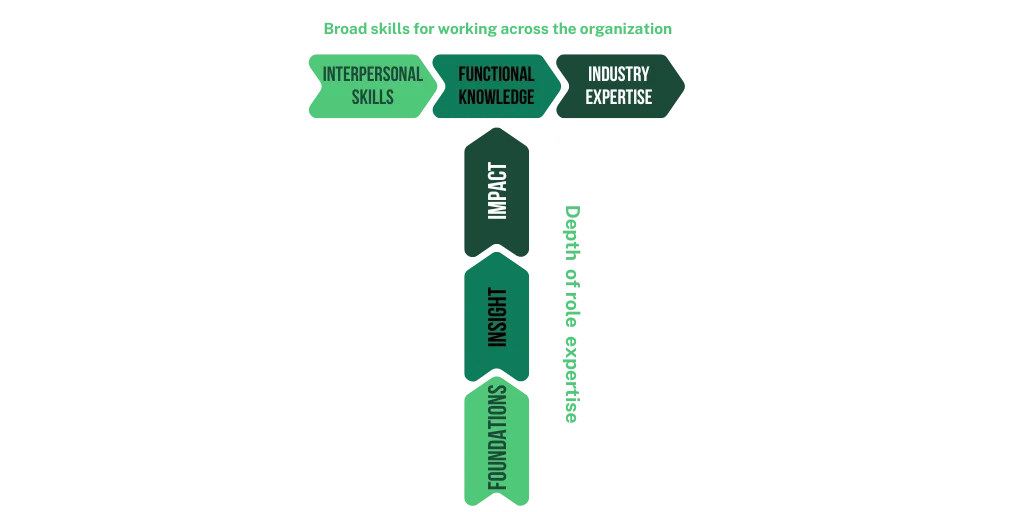

A useful way to visualize the role is through the “T-shaped” skills framework, a model originally popularized by McKinsey. While it was first applied to general leadership and innovation roles, it transitions beautifully into the world of startup CFOs.

What Does “T-Shaped” Mean?

- The vertical bar of the T represents deep expertise in a core domain. For a CFO, this means mastery of finance: everything from accounting foundations to strategic capital allocation.

- The horizontal bar represents a broad understanding across multiple disciplines, from product and sales to operations, people, and marketing. This breadth allows CFOs to collaborate effectively across functions, influence decisions, and drive growth.

In other words, a T-shaped CFO excels in their financial craft while also bringing versatility, business acumen, and people skills to the table.

The Vertical Bar: Finance Foundations, Insight & Impact

The vertical axis of the CFO’s “T” can be thought of as three layers of financial leadership:

1. Foundations

At the base level, the finance leader ensures accuracy, consistency, and reliability in the company’s financial systems.

Strong foundations ensure that financial information such as month-end and management reporting is fit for purpose, being produced and delivered accurately and timely. It is also here that finance leaders are establishing and overseeing that the correct processes and systems: finops, financial controls and finance technology are implemented.

These “hard skills” create the bedrock for everything else:

- Building scalable accounting and reporting systems

- Ensuring compliance and governance

- Establishing consistent monthly closes

- Laying the groundwork for audits and due diligence

This hands-on stage is often best owned by a Controller rather than a senior finance leader like a CFO or VP of Finance. Their focus is on execution and getting the mechanics right. However, the CFO is accountable for ensuring that these foundations exist, because without them, it’s impossible to move into the more strategic work of insight and impact.

2. Insight

Once the basics are covered, the finance leader moves onto the quality of the data and the strategic insights it can provide to the business.

The middle of the T is insight-led, which allows the finance leader to own budgeting and forecasting, developing and refining the financial model, shaping capital allocation strategies, building FP&A capabilities, creating dashboards and KPIs, and turning data into actionable decisions.

Here, the work is about turning numbers into decisions:

- Developing forward-looking financial models

- Creating capital allocation business cases

- Supporting data-driven decisions across the business

- Presenting financials clearly to boards, founders, and investors

At this stage, the CFO also plays a key role in investor reporting and analysis: translating numbers into narratives that drive confidence and strategic alignment.

This is also where soft skills shine. It’s not enough to crunch numbers, the CFO must tailor messages to different audiences, influence strategy, and inspire confidence.

At this level, a Head of Finance or Finance Director should already be developing these skills and competencies to set themselves on the path to becoming a versatile and impactful CFO.

3. Impact

At the top level, the CFO becomes a true business partner to the CEO and leadership team. Here, the CFO is no longer just “the finance person”, they’re shaping the long-term vision of the company.

The top section of the vertical emphasizes taking a strategic approach to the business. This means positioning the company for future fundraising rounds, mergers and acquisitions, potential exits, or IPO readiness. It also involves engaging with investors and stakeholders, while working closely with other departments to maintain strong strategic alignment across the organisation.

Impact-driven CFOs are able to:

- Navigate all forms of fundraising and capital markets

- Lead M&A processes end-to-end

- Maximize enterprise value ahead of a potential exit

- Drive sustainable growth through data-backed decisions

This is where the best startup CFOs operate, turning financial insight into enterprise-wide impact. At this stage in a scaling business, it's essential that a CFO spends as much time as possible in areas of insight and impact.

The Horizontal Bar: Breadth of Knowledge & Soft Skills

What makes a CFO “T-shaped” is not only financial expertise but also the ability to span across the business.

1. Interpersonal Skills

Perhaps the most underestimated skill set. In startups, CFOs must bring founders, teams, and investors along the journey. Based on conversations with CFOs, investors, and founders, the most sought-after traits include:

- Emotional intelligence

- Strong communication & storytelling

- Influencing without authority

- Building trust with stakeholders

- Resilience under pressure

Traits such as resilience, charisma, agility and the ability to negotiate and influence others are the perfect example of interpersonal skills a strong CFO should possess.

These aren’t “nice to haves”, they’re core to being effective.

2. Functional Knowledge

In earlier-stage startups, CFOs often wear multiple hats, sometimes doubling as COO, leading People, Legal, or IT. At later stages, CFOs have to influence functions outside finance, which is why having at least a base knowledge of other functions is essential. Meaning they can:

- Partner effectively with Sales, Marketing, Product, and Tech Departments

- Provide strategic oversight and challenge when needed

- Influence cross-functional decisions with credibility

3. Industry Expertise

While CFOs can and do transition across industries, deep sector knowledge is often a huge advantage. For example, a CFO moving from B2B SaaS to another SaaS business can:

- Hit the ground running on key metrics and playbooks

- Leverage existing investor networks

- Understand industry levers that drive growth and valuation

- Strong knowledge of competitors and pricing

Having a solid understanding of other business functions, paired with deep industry insights, provides the CFO with a complete set of broad skills necessary to navigate any business, regardless of size or industry.

This knowledge accelerates impact and builds confidence with both CEOs and investors.

Why the T-Shaped CFO Matters for Founders

Every business will have a different CFO “shape” depending on stage and priorities:

- Early-stage founders might prioritize a CFO with strong foundations and hands-on commercial support.

- Growth-stage companies often need CFOs who bring sharp insights and investor credibility.

- Later-stage ventures benefit from impact-driven CFOs who can steer fundraising, M&A, and exits.

The T-shaped visual helps clarify what kind of finance leader you actually need, not just for today, but for the future journey of the business.

Final Thoughts

The most impactful startup CFOs go beyond traditional financial management. They are strategic partners to the CEO, respected voices in the leadership team, and drivers of sustainable growth.

By thinking about the CFO role through the T-shaped lens, founders and finance leaders alike can better understand the skills required, set clearer expectations, and ultimately build stronger, more scalable businesses.