May Fundraising Feature: UK & NY

02 Jun, 20256 Minutes

Welcome to our 5th edition of the Fundraise Feature, in which we bring you an overview of the Seed - Series B tech fundraises from across the United Kingdom and New York, that were announced in the month of May.

Keep reading to get a breakdown of some of last month's notable deals and the main investors that backed these exciting raises, all thanks to PitchBook's research.

United Kingdom

During the month of May, 32 companies across the Seed - Series B tech space successfully secured funding from 139 investors, who collectively invested nearly £430M into businesses across the UK.

Highest Capital Investment

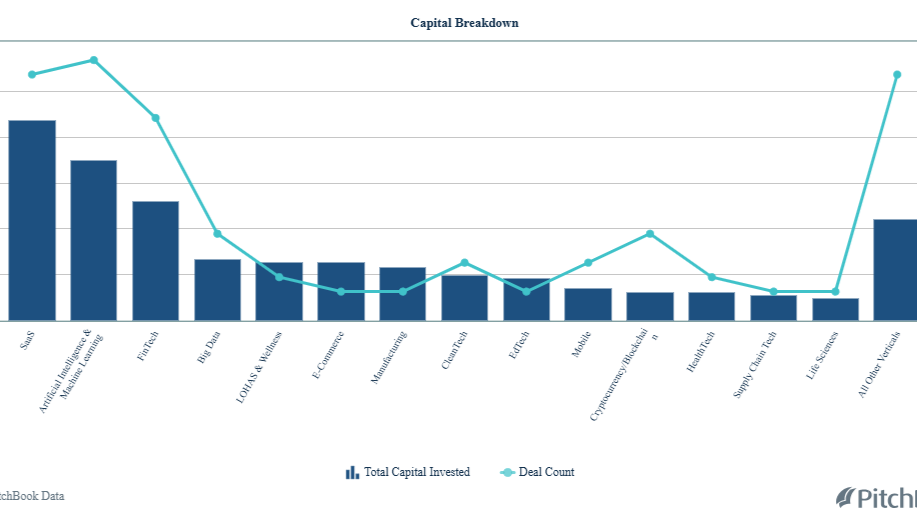

In the month of May, three industries emerged as clear leaders in terms of attracting investor capital: SaaS, FinTech, and AI & Machine Learning.

SaaS topped the chart with a remarkable £210M in total capital invested, making it the most heavily funded sector during the month. This capital was deployed across 8 deals, reflecting investor confidence in scalable, subscription-based business models that drive digital transformation across industries. FinTech followed closely, securing £180M in funding spread across 7 deals. This sector continues to be a magnet for investment due to ongoing innovation in digital payments, lending platforms, embedded finance, and decentralized finance (DeFi). AI & Machine Learning stood out not just for the £145M raised, but also for its high deal count of 11.

We would like to congratulate a few selected businesses from these industries for their amazing fundraising achievements:

Orca AI, a marine collision avoidance system that utilizes artificial intelligence to enhance safety in the maritime industry, successfully raised £55M in their latest Series B round.

Navro, a fintech platform developer that enables brands to scale their payment operations globally, has secured £36M in their Series B funding round.

Granola, a developer of an artificial intelligence notepad application designed for teams, has raised £32M in their Series B round.

Notable Investors

Behind each capital allocation are some of the most active and influential investors in the venture capital landscape. These include a mix of early-stage venture capital firms and growth funds that consistently back high-potential startups with strategic capital and expertise. Here's a highlight of some of the investors that made a difference in the month on May:

Early Game Ventures, for supporting Servo AI and PlaySafe ID.

Spark Capital, for backing Granola and Ravio.

Funding Stages

As a community of early-stage finance leaders, founders, and investors in the tech startup space, we focus on the Seed to Series B funding stages.

This is how the capital investment allocation was split between these stages in May:

- Half of all capital invested (50.03%) went into Series B rounds, indicating strong investor interest in more mature, growth-stage startups. These companies are likely showing strong revenue traction and market fit, attracting investments from later-stage investors.

- Series A rounds received over a third of total capital (36.26%), showing continued support for startups that have validated their product-market fit and are scaling operations.

- Only around 13.7% of capital went into seed-stage deals, suggesting a more selective funding environment for very early-stage companies.

Summary

Overall, May saw strong investment activity, with capital being mostly concentrated in growth-stage sectors and later-stage rounds. SaaS led with £210M across 8 deals, followed by FinTech (£180M, 7 deals) and AI & Machine Learning (£145M, 11 deals). Series B rounds accounted for over 50% of total capital, reflecting investor preference for mature, scalable startups. Series A received 36%, while Seed funding made up just 14%, indicating a more cautious early-stage environment.

New York

In New York, the tech startup ecosystem remained active, with 52 companies securing funding, backed by 202 unique investors. The total capital invested reached over £500M, with the largest single deal valued at £56.21M.

Highest Capital Investment

Mirroring the investment landscape in the UK, the New York market also invested heavily into SaaS, AI & Machine Learning and Fintech.

SaaS being a versatile industry that accelerates digital transformation, it has successfully closed 17 deals and secured £220M in invested capital. SaaS has also strong integration capabilities, being used across different industries. AI & Machine Learning closed 18 deals which brought £175M of investment into this sector. AI is revolutionising how businesses operate, automating tasks, improving decision-making, and unlocking new capabilities, being a rapidly expanding market with breakthroughs in machine learning, natural language processing, and computer vision. Fintech has received £130M in funding, through 14 closed deals. The financial services sector is massive and ripe for digital disruption, where this capital can be used to further fuel innovation.

Here's a few selected companies from these industries that have raised significant capital:

Siro, an artificial intelligence-powered tool for recording and analysing in-person sales conversations, has raised £37M in their Series B funding round.

dub, a developer of a social finance platform that connects retail and professional investors, has secured £22M in their Series A funding round.

Surge AI, a natural language processing data labelling platform designed to help clients create powerful and human-centred datasets, received £18.8M in their latest Series A round.

Notable Investors

Besides providing valuable capital, investors offer strategic guidance, networks, and credibility that help startups navigate competitive markets. Here's a highlight of the main investors this month:

AlleyCorp, for supporting Clarium Health and Henry Capital.

Andreessen Horowitz, for backing Inductive Bio and KYD Labs.

Northzone Ventures, for providing capital to Clarium Health and Filed.

Funding Stages

Our network brings together finance professionals, founders, and investors focused on supporting tech startups through the Seed to Series B journey. Here's how the capital investment was allocated during the month of May:

- Series B dominated the majority of the capital allocations, with 53.26% of capital going towards later-stage businesses, which are often on a path toward a strategic acquisition or IPO.

- Seed and Series A businesses shared the rest of the capital in a similar proportion, with Seed receiving a quarter of the investments (25.71%) and Series A received just over a fifth of the total amount (21.03%).

Summary

New York had a busy May, where investments were mostly concentrated towards the later-stage businesses, with Series B accounting for over 53% of the total allocated capital. SaaS was the most invested industry, securing £220M in capital, but AI & Machine Learning had the highest amount of closed deals (18), having obtained £175M.

We are excited to see you next month for the Q2 wrap up.