Keep reading to get a breakdown of some of last month's notable deals and the main investors that backed these exciting raises, all thanks to PitchBook's research.

United Kingdom

In April, 38 companies between the funding stages of Seed and Series B received investment from 164 investors, with the total capital allocated being almost £385M.

Highest Capital Investment

AI & Machine Learning, Fintech and SaaS were the most invested industries during the month of April, with each industry securing just under £160M in funding.

A massive congratulations to these companies that have received funding in these industries:

incident.io, a developer of an incident response platform designed to create, manage, and resolve incidents directly in Slack, securing £48M in their Series B fundraise.

NexGen Cloud, an enterprise AI cloud infrastructure designed to support modern Generative AI workloads, received £35M in Series A investment.

Navro, a fintech platform designed to allow brands to scale their payment operations globally, obtained just over £30M in their Series B funding round.

CleanTech and Cryptocurrency/Blockchain joined the top 5 most invested industries in April, £90M being allocated to CleanTech and £74M to Cryptocurrency.

Congratulations to KSD Miner, a trading platform designed to ensure easy navigation and a continuous mining experience for users, for securing the highest funding amount in the past month.

Notable Investors

As per usual, we would like to highlight the most active investors during April, that made these funding deals possible.

Fuel Ventures, for supporting 51toCarbonZero, Damisa, Sagittal and Trusted.

Active Partners, for providing funding to Limitless Travel, Poolhouse and Unravel.

SFC Capital, for backing Lumin, Pathfinder Bio and WineFi.

Funding Stages

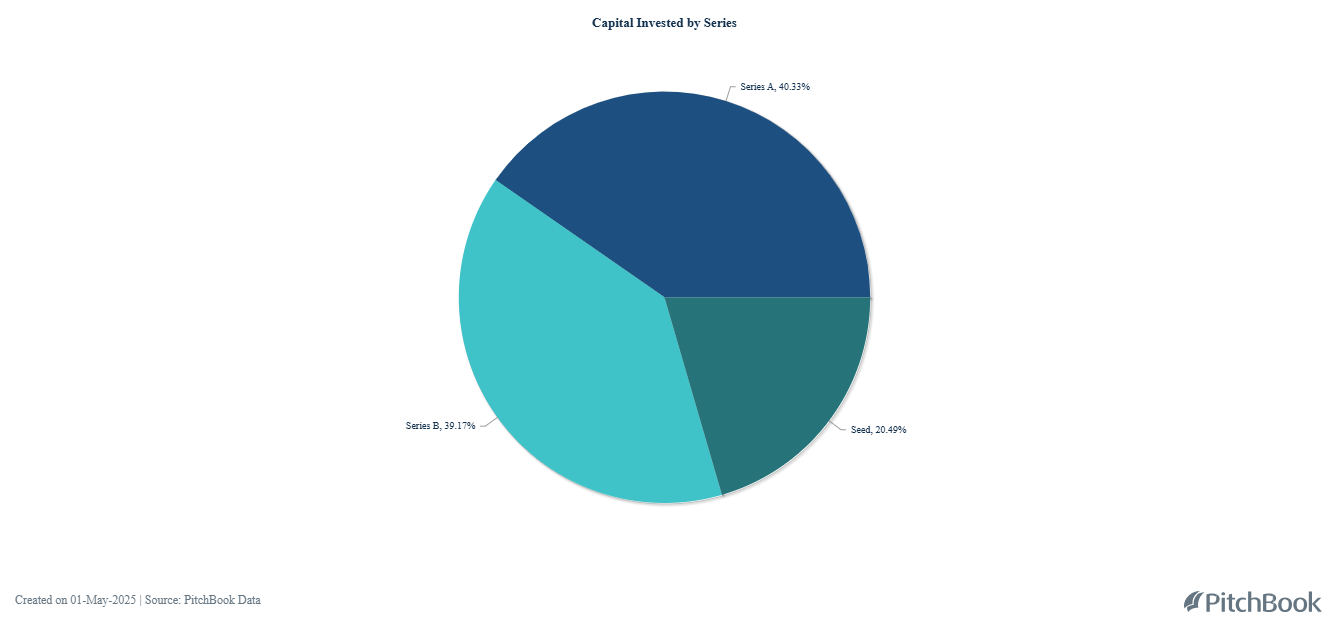

Given that our network primarily consists of early-stage finance leaders, founders, and investors in the tech startup space, we are focusing on the Seed to Series B funding stages.

In April, this is how the capital investment allocation was split between these stages:

- Series A and B seemed to be the preferred funding stages to invest in, with Series A accounting for 40.33% of investments, and Series B following closely with 39.17%.

- In April, funding stages at Seed received 20.49% of the total invested capital.

Summary

In the UK, the month of April saw £385M of capital being mostly invested into Series A and Series B companies, with the top 3 most invested industries being AI & Machine Learning, Fintech and SaaS. This significant investment activity highlights the continued interest in innovation-driven businesses and scalable digital solutions.

New York

In New York, there were 53 deals closed in the month of April, counting with the help of 254 investors and a whopping £640M of capital being invested across Seed, Series A and Series B funding stages.

Highest Capital Investment

The most invested industry in New York was SaaS, receiving £336M in capital. AI & Machine Learning was the second most invested industry, having been allocated £286M in capital.

A huge congratulations to these companies for receiving amazing capital investments:

Lightrun, a developer of an observability platform designed to allow developers to solve production issues, secured the highest investment in the month of April, a whopping £53.68M in their Series B fundraise.

Minimus, a secure container for images designed to minimise exposure and simplify vulnerability management, has successfully raised an impressive amount of £39M in their Seed funding round.

Arena.AI, an operator of an information technology firm intended to enhance business processes, has raised £23M in their Series B funding round.

Cybersecurity, HealthTech and FinTech complete the top 5 most invested industries for this month, with the capital allocation towards these industries being £111M for Cybersecurity and £93M for HealthTech and FinTech.

A round of applause for these companies that stood out in the month of April across these industries:

Sentra, a developer of a cybersecurity platform designed to enable cloud-driven organisations to regain control and secure data, has secured £38M in their Series B round.

Healthee, a health benefits platform designed to simplify and streamline the healthcare experience, has raised £38M in their Series B fundraise.

Zoe Financial, a wealth planning platform designed to help people find financial advisors, received £22M in their Series B funding round.

Notable Investors

A special mention to the amazing investors who made the difference in April with their capital contributions.

Andreessen Horowitz, for supporting Adaptive, Blackbird Labs and Crux.

Insight Partners, for providing capital to Blooming Health, HoneyHive and Lightrun.

Y Combinator, for backing Blue Onion Labs, Glimpse and Octolane AI.

Funding stages

In the month of April, here is how the funding allocation looked like between the Seed, Series A and Series B funding stages:

- Series B was the most invested stage, with 40.93% of the total allocated capital going towards this funding stage.

- Series A received 32.67% of the invested capital, and Seed received just over a quarter (26.4%)

Summary

Q2 started strong for New York, with 254 investors closing deals with 53 companies and providing £640M of capital to startups in the Seed - Series B space. SaaS and AI & Machine Learning were the most invested industries and 40% of deals were closed at the Series B funding stage.

Make sure to join us next month for the May funding report.