How Can AI Help CFOs Make Remarkable Impact?

08 Apr, 20248 minutes

Embracing AI in Startups

In the ever-evolving landscape of startups, embracing cutting-edge technologies is paramount for driving innovation and maintaining competitiveness. Among these technologies, Artificial Intelligence (AI) has emerged as a transformative force, offering startups the potential to revolutionize operations, enhance decision-making processes, and deliver personalized customer experiences. In a study done by Trullion, AI and Automation are projected to have a bigger 10-year impact than Cybersecurity, Analytics and Big Data, Biotech, and Renewable Energy combined.

But how will this affect the Finance function and the ever-evolving role of the CFO? According to a study by McKinsey, AI adoption in finance functions can lead to cost savings of up to 25% by automating repetitive tasks and improving efficiency. AI presents startups with the opportunity to automate routine tasks, freeing up valuable time and resources that can be redirected towards strategic initiatives. By leveraging AI-powered automation, startups can streamline operations, increase productivity, and drive efficiency across various departments.

During a recent CFO Roundtable we hosted, the most prevalent topic of conversation during the evening revolved around how AI can support CFOs and Finance Functions. We then started researching the opportunities and challenges CFOs will face when embracing AI to drive financial performance and strategic growth. In this article, we will assess the current presence AI has in the startup ecosystem, the benefits it can provide to CFOs but also highlight the fundamental human elements required from a CFO, that are unlikely to be supplanted by Artificial Intelligence.

AI's Impact on the Financial Industry

AI has already established a significant presence in the financial industry, transforming various aspects of banking, investment, insurance, and other financial services. According to a 2022 McKinsey survey, the adoption of AI has more than doubled since 2017. In 2017, only 20% of respondents reported using AI in at least one business area, whereas in 2022, this figure rose to 50%.

One of the greatest areas where AI adoption can support CFOs is through data analysis and forecasting. AI technologies can analyze large volumes of financial data quickly and accurately. This enables CFOs to gain valuable insights into financial trends, predict future performance, and make data-driven decisions.

The global AI financial services market is forecasted to achieve a value of $130 billion by 2027, marking a substantial growth from $8 billion in 2019, according to a market analysis by Emergen Research in 2021. As companies are committing more budget to AI and realizing its rapidly growing potential, CFOs are commonly gaining the responsibility to ensure their organization embraces it, to maximize future success and gain a competitive edge. More often than less, the responsibility for the overall technology stack often falls on the shoulders of the CFO, who holds a pragmatic stance within the C-suite.

CFOs' Evolving Role in AI Adoption

As the CFO assumes greater authority over technology spending, they are strategically positioned to advocate for investments in advanced fintech solutions and to champion the unique opportunities presented by AI. In 2020, MIT Sloan research suggested that CFOs did not perceive themselves as spearheading the adoption of AI. However, in the present day, CFOs are undeniably pivotal in leading the charge for AI adoption, actively involved in assessing, evaluating, and implementing technology solutions within their domain.

This article may be your first step into researching how AI can support you as CFO specifically, therefore we want to highlight some of the ways it can massively benefit your finance function. We understand that having intensely studied for years, finance professionals want to develop their careers beyond manual, repetitive tasks. Trullion reported that 95% of finance professionals spend at least an hour a day on Excel, with 61% spending over 4 hours using this tool. AI-powered automation can streamline repetitive tasks such as invoice processing, expense management, and financial reporting and can save CFOs time, reduce errors, and allocate resources more efficiently.

Balancing Automation with Human Expertise

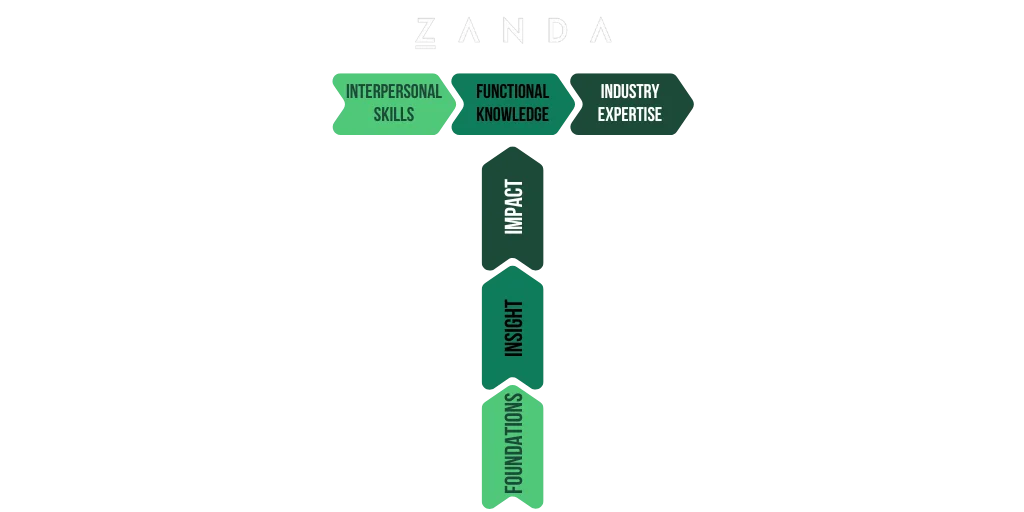

Allowing AI to supplement the CFOs day-to-day requirements will free them up to focus on the critical functions and qualities that AI cannot replace, like strategic decision-making. This vital task requires human judgment, intuition, and an understanding of broader business objectives and contexts. CFOs play a crucial role in leading finance teams, collaborating with other departments, and communicating financial insights to stakeholders. These tasks require empathy, persuasion, and driving alignment across the organization. AI can however, provide CFOs with advanced analytics and scenario modeling capabilities, allowing them to develop more accurate financial forecasts and focus on building trust, credibility, and integrity with vital relationships.

One relationship AI can help strengthen though, is with the customer base. Artificial integration allows startups to offer personalized experiences based on individual preferences, which can strengthen relationships and loyalty. For example, AI-driven tools like recommendation engines, chatbots, and virtual assistants all enable personalized engagement.

Evaluating AI Costs and Benefits

Despite the undeniable benefits of AI, startups must carefully assess the costs associated with its implementation. This includes initial investments in AI technologies as well as ongoing expenses for talent acquisition and training. CFOs are tasked with conducting comprehensive cost-benefit analyses to ensure a positive return on investment. AI can support this however, through identifying cost-saving opportunities across various aspects of financial operations, such as procurement, inventory management, and budgeting. This could in turn provide the company with returned capital to scale their AI support.

Notably, reports by Gartner suggest that AI adoption in finance functions can enhance scalability by automating processes and enabling organizations to manage larger volumes of data without significant increases in resource requirements. Thus, CFOs should meticulously evaluate the financial implications of AI initiatives, considering both immediate costs and long-term benefits. By quantifying the ROI of AI investments, CFOs can make well-informed decisions and allocate resources efficiently.

Managing Risks Responsibly

One final consideration for CFOs is how AI can support them with risk management. With the rise of cybersecurity threats and regulatory complexities, startups must prioritize risk management. AI algorithms can identify potential risks and anomalies within financial data, helping CFOs to mitigate risks effectively. This includes detecting fraudulent activities, identifying market fluctuations, and assessing credit risks.

All of these opportunities provided by artificial intelligence can enhance the finance function substantially, but the widespread adoption of AI does raise ethical and social concerns, including issues of algorithmic accountability, job displacement, and societal impact. Therefore, CFOs must navigate these complexities responsibly, considering the broader implications of their AI initiatives and acting in accordance with ethical principles and values. CFOs should champion responsible AI practices within the organization, considering ethical implications and societal impacts when deploying AI technologies. By adhering to principles of transparency, accountability, and fairness, startups can build trust with stakeholders and demonstrate their commitment to ethical AI.

Conclusion

As startups navigate the complex terrain of AI adoption, CFOs play a pivotal role in guiding their organizations towards success. By leveraging the opportunities presented by AI while addressing the associated challenges, startups can unlock new possibilities for innovation, growth, and competitiveness. Through strategic planning, careful evaluation, and responsible implementation, startups can harness the power of AI to drive financial performance, mitigate risks, and create value for their stakeholders in the digital age.