Practical Guidelines For Managing And Distributing Equity Effectively

16 May, 202410 minutes

Vestd is the UK's first and most advanced share scheme platform for startups, scaleups and SMEs. Vestd makes it simple for company leaders to give their teams, advisors and contractors shares or options!

In this comprehensive article, we have included Ifty’s expert strategies and best practices for managing equity effectively, as discussed during our event. Dive in to gain a deep understanding of the risk-reward ratio and how to implement vesting structures for both fractional and full-time employees.

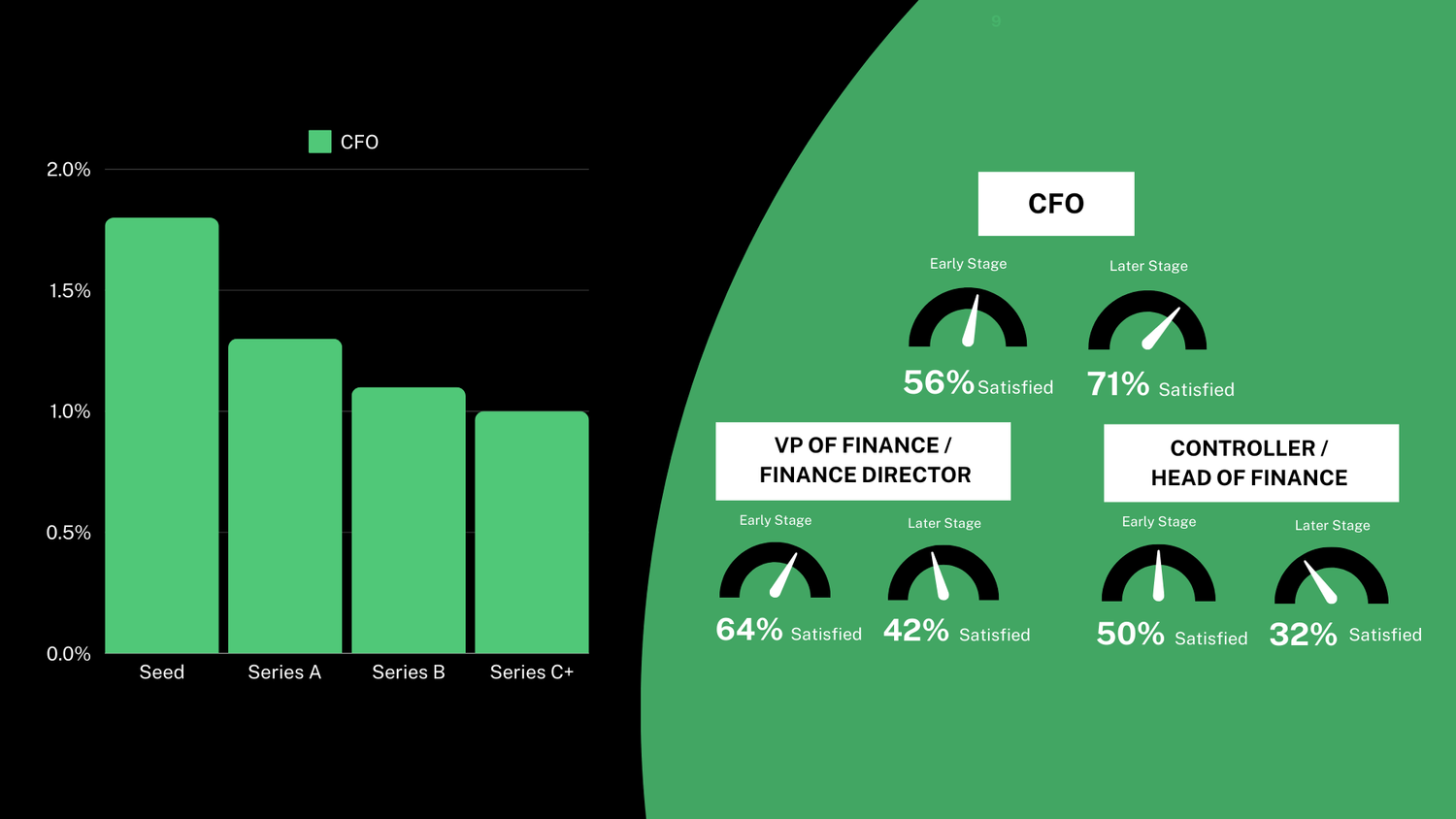

Extract from our 2024 UK Startup Finance Leader Salary Guide, highlighting the data from our 2023 Salary and Equity Survey.

1. Assessing the Risk-Reward Ratio:

- Understanding Startup Stages: Before diving into equity distribution, it’s crucial to grasp where your startup stands on the growth spectrum. Are you in the nascent stages, still fine-tuning your product-market fit, or are you further along, gearing up for expansion? Each stage comes with its own set of risks and opportunities, which directly influences your approach to equity.

Finding the Sweet Spot: Balancing risk and reward is akin to walking a tightrope. You want to entice top talent without overcommitting your company’s equity too early in the game. Consider what level of equity offering will attract the right people while still preserving enough for future rounds of investment and growth.

Full Vesting, Full Commitment: Regardless of your startup’s stage, ensuring that your team is fully vested in the company’s success is non-negotiable. Equity can be a powerful motivator, aligning everyone’s interests with the long-term goals of the business. When employees are fully vested, they’re more likely to go the extra mile and weather the inevitable ups and downs of startup life.

Extract from our 2024 UK Startup Finance Leader Salary Guide

2. Embracing Fractional Expertise:

Identifying Skill Gaps: Every startup has its strengths and weaknesses. Recognising where you could benefit from specialised knowledge can be a game-changer. Whether it’s financial expertise, marketing savvy, or technical know-how, fractional talent offers a cost-effective solution to filling those skill gaps.

Flexibility without Compromise: Hiring full-time executives can be prohibitively expensive for early-stage startups. Fractional professionals offer the best of both worlds: specialised expertise without the hefty price tag or long-term commitment. This flexibility allows startups to access high-level guidance precisely when they need it most.

Aligning Incentives: While fractional experts may not be punching the clock in your office every day, their impact on your startup’s success can be profound. By tying their compensation to the company’s performance through conditional equity grants like growth shares, you ensure that their interests are aligned with yours for the long haul.

Extract from our 2024 UK Startup Finance Leader Salary Guide

3. Key Hygiene Factors in Equity Distribution:

Playing by the Rules: Equity distribution isn’t a free-for-all; it’s governed by a complex web of regulations and tax implications. Failing to dot your i’s and cross your t’s can lead to costly mistakes down the road. Make sure your equity schemes are set up and maintained in compliance with relevant laws and regulations. It's important to note that not all share schemes are government regulated. However, opting for HMRC-backed methods of sharing can often be more tax-efficient.

Communicating Clearly: Ambiguity is the enemy of equity agreements. Whether you’re granting equity to employees or investors, clarity is key. Clearly spell out the terms and conditions attached to equity grants to avoid misunderstandings or disputes later on.

Counting Shares, Not Percentages: While it may be tempting to divvy up equity in percentages, it’s a recipe for headaches down the line. As your startup evolves and undergoes funding rounds, maintaining equity percentages becomes increasingly complex. Instead, anchor equity grants to a fixed number of shares to simplify management and avoid future complications.

4. Practical Guidelines for Equity Management:

- Checklist for Compliance: Create a checklist to ensure that every step of your equity allocation process is compliant with relevant regulations and best practices. From initial grant agreements to ongoing reporting, staying on the right side of the law is paramount.

Standardised Documentation: Develop standardised templates for equity grant agreements that cover all the necessary bases. These templates should include clear language, comprehensive terms, and provisions for any contingencies that may arise.

Tracking and Transparency: Implement robust systems for tracking equity grants and vesting schedules. This not only ensures transparency but also helps you stay on top of important milestones, such as upcoming vesting events or deadlines for option exercises.

Education and Awareness: Equity management isn’t just a job for the finance team; it’s something that every member of your startup should understand and appreciate. Educate employees, investors, and other stakeholders on the importance of equity hygiene and the role they play in its maintenance. By fostering a culture of awareness and accountability, you set your startup up for long-term success.

As highlighted in our 2024 Equity & Compensation benchmarking report there are a substantial number of individuals who have witnessed a reverse trend in the valuations of their businesses, resulting in a depreciation of finance leaders' equity value. Consequently, this has resulted in a heightened interest in these individuals to actively seek new opportunities.

Extract from our 2024 UK Startup Finance Leader Salary Guide, highlighting the equity satisfaction statistics from our 2023 survey

Having said that it, it is noticeable that the majority of CFOs are still satisfied with their equity component, highlighting how circa 1% of equity still means a lot to finance leaders when they believe in the long-term potential of their business.

By following the actionable steps and best practices outlined in this article, startups can navigate the complexities of equity distribution with confidence and integrity. By fostering a culture of alignment and accountability through effective vesting strategies, organizations can attract and retain top talent while positioning themselves for sustainable growth and success.

Watch the full event recording that this guide was taken from here and also download our 2024 UK Equity and Compensation benchmarking report here.